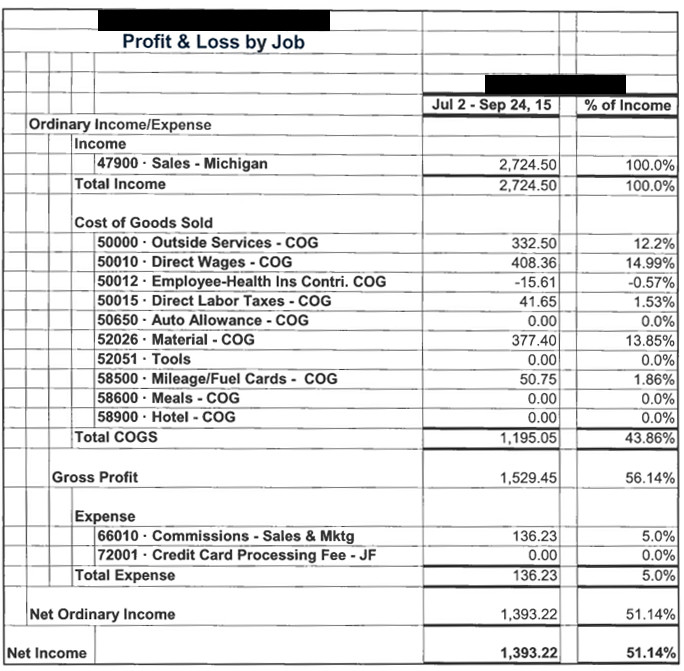

One major issue contractors tend to have is getting a handle on job costing. What is job costing? Job costing is the analysis of your true costs for the entirety of a job to know if you’re making a profit. If you already use accounting software like Quickbooks or Freshbooks these tools have the ability to do job costing for you at the end of your accounting period. However, you need to accurately track and input information into your software and have the ability to verify your actual costs to your estimate; the software’s not going to do it for you. Profits don’t happen by magic, they happen when contractors have a solid understanding of job costing and they put that knowledge to use. Implementing proper job costing can literally be the difference between making a profit and going broke.

Putting processes in place

The key to getting your job costing right is to create processes to ensure that all of your costs are recorded and reported correctly. Here are some basic things you can do to make this happen:

- Mark all receipts. If you purchase any materials for a job from Lowe’s or Home Depot make certain that the name of the job ends up on that receipt. If you’re a painting contractor and you purchase ceiling paint that’s going to be used on two separate jobs then mark the receipt as “1/2 to Job A and ½ to Job B.”

Diligently track inventory. If you carry any inventory it’s critical that you track when and where it is used. Many small or mid-size contractors carry small amounts of inventory and forgetting to track these expenses can make jobs appear much more profitable than they are.

- Have a process to track employee time, mileage, etc. Another issue contractors often run into is accurately gauging their labor costs. You’ll need to have all of your employees track their time and mileage specific to each job and make sure their hours align with your quoted labor hours for the job. Discrepancies here can be costly and signal that you’re underestimating hours for certain types of work or your employees are taking too long on certain tasks.

- Audit hours and materials from subcontractors and suppliers. Depending on how much work you do with subcontractors and the amount of suppliers you work with, this can also cause major issues for those not familiar with job costing. If a supplier or subcontractor overcharges and you’re not diligently tracking your costing, a project with a slim margin can quickly turn to a loss.

- Regularly review your costs. Your business may change over time and it’s important to make sure you create processes for any new costs that may arise. For example, if you begin offering commissions for bringing in jobs, that needs to be a part of your job costing as well. Does your crew have additional travel costs like lodging? Don’t forget seemingly innocuous things like credit card processing costs, insurance and taxes either, all of these things contribute to your profit and loss.

Diligently track inventory. If you carry any inventory it’s critical that you track when and where it is used. Many small or mid-size contractors carry small amounts of inventory and forgetting to track these expenses can make jobs appear much more profitable than they are.

Diligently track inventory. If you carry any inventory it’s critical that you track when and where it is used. Many small or mid-size contractors carry small amounts of inventory and forgetting to track these expenses can make jobs appear much more profitable than they are.